Technological Impact

Since acquiring VMware, Broadcom has made drastic changes in the company’s go-to-market. The organization has been consolidated into fewer business units, with the primary business unit being VMware Cloud Foundation (VCF). VCF is the primary offering, and the majority of VMware’s R&D is going into this platform. Already, Broadcom has announced a new version (5.2) of the offering with many features that will help customers adopt the platform.

Market Dynamics

Ever since Broadcom announced its intent to acquire VMware in early 2022, the news was met with concern from many industry experts who know Broadcom’s reputation. The company is known for increasing the cost of customer renewals post-acquisition. And although Broadcom CEO Hock Tan addressed these concerns with a brief message during the VMware Explore 2023 keynote, many customers’ fears have come to pass as their renewal dates approach.

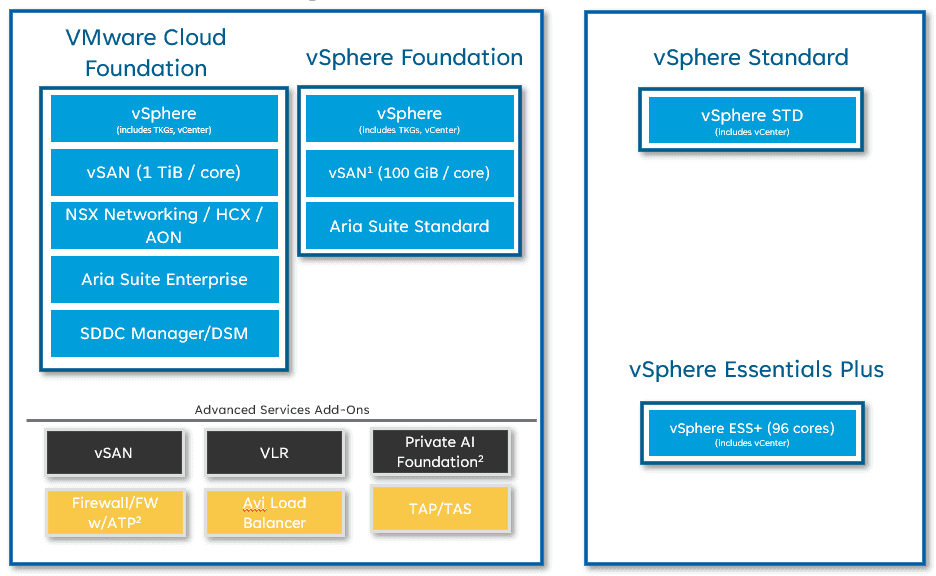

While it is true that Broadcom did not raise the prices of existing SKUs, customer renewal costs have gone up significantly due to the retirement of all perpetual SKUs and a limited selection of subscription bundles that customers are able to buy. So, while a customer may prefer to buy traditional virtualization software only, they have no choice but to buy a bundle with extra functionality at a higher overall cost.

Figure 1. VMware’s on-prem software offerings as of July 2024

As mentioned, the primary offering is VCF, but there are a few other bundles, such as VMware vSphere Foundation (VVF). We have seen many of our strategic customers request pricing for VVF rather than VCF only to be refused by Broadcom, who will only provide VCF pricing.

Most of our customers who have a renewal due this year have chosen to renew licensing for their existing environment with an eye toward the future. Many intend to reduce their dependency on VMware by moving as many workloads as possible to other platforms.

The first question we get in many situations is, “what is the best alternative to VMware for on-prem virtualization?” While there are many possible technology platforms that customers could land their workloads on, there will certainly be sacrifices in functionality or third-party integrations in making a change. VMware has built the most mature hypervisor platform and ecosystem on the market, and nobody has come close to matching them.

So, while a customer may get an acceptable or even exceptional outcome by choosing a platform like Nutanix or Azure Stack HCI (our two most popular offerings to date), they could find themselves with unexpected purchases of hardware or third-party software to accommodate the change, or sacrifices in functionality.

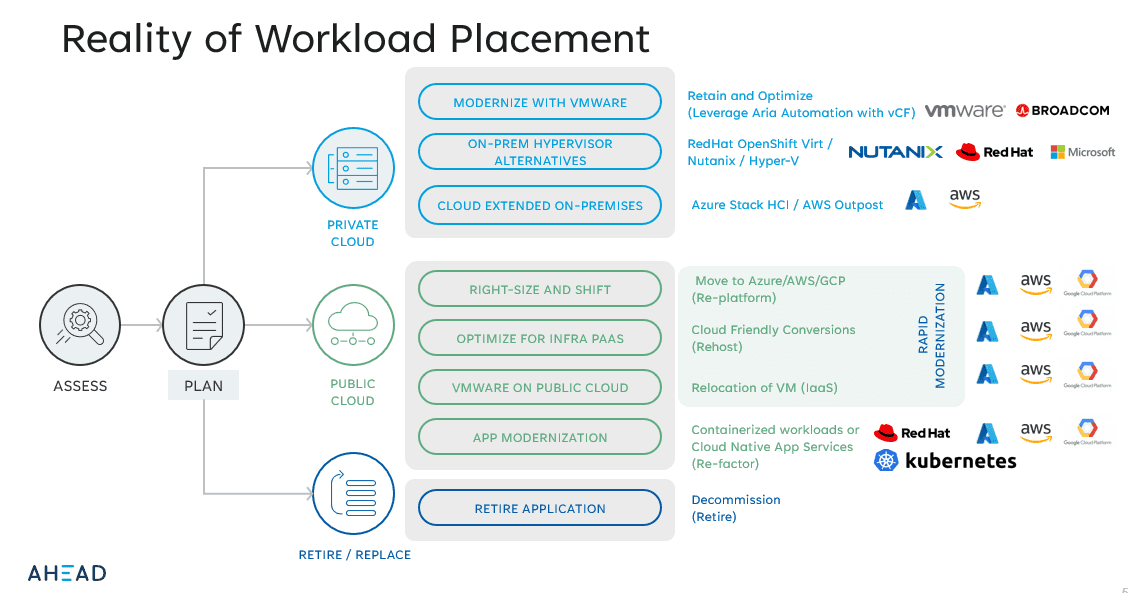

Figure 2. AHEAD’s GTM around VMware alternatives is about modernization and workload placement – not product-led solutioning.

As a result of these challenges, AHEAD’s primary message is that the Broadcom acquisition should be used as an inflection point to evaluate where workloads should land in general (virtualization, cloud, SaaS, etc.) rather than focusing on a feature parity on a hypervisor. This has been well met by customers who are wary of tactical solution sales rather than strategic advice.

Looking to the Future

Overall, we are seeing a “tectonic shift in the industry,” as AHEAD CTO Eric Kaplan put it earlier this year. We will likely continue to see organizations who need best-in-breed virtualization on-prem continue to use VMware in perpetuity, albeit on a smaller scale over the next few years.

There are a few up-and-comers who are challenging VMware in terms of feature functionality, such as Nutanix and ProxMox VE. But there are roadblocks to adopting those platforms for many customers, such as rigid architecture or lack of enterprise support. As such, there will likely be advancements to these platforms that result in a more fragmented approach to virtualization, and workload placement in general, across the industry.

Stay tuned for new information on VMware/Broadcom as things change, and get in touch with AHEAD to learn more.

About the author

Ken Nalbone

Senior Specialist Sales Engineer

Ken Nalbone is a Senior Specialist Solutions Engineer in AHEAD's Modern Data Center practice with 20 years of experience in Enterprise IT, both within on-prem data centers and public cloud. He focuses primarily on software defined architectures. Ken enjoys writing about himself in the third person from time to time.

;

; ;

; ;

;